One Person company Registration

Dream Big, Start Small – OPC is the Way to Go!

From Entrepreneur to Business Owner: The OPC Way!

Get Your Online company Registration in Just 7-10 days at Rs. 2,999/-** only.

- Get Instant Quote

What’s Included ✅

- MCA Name Approval

- MOA & AOA Drafting

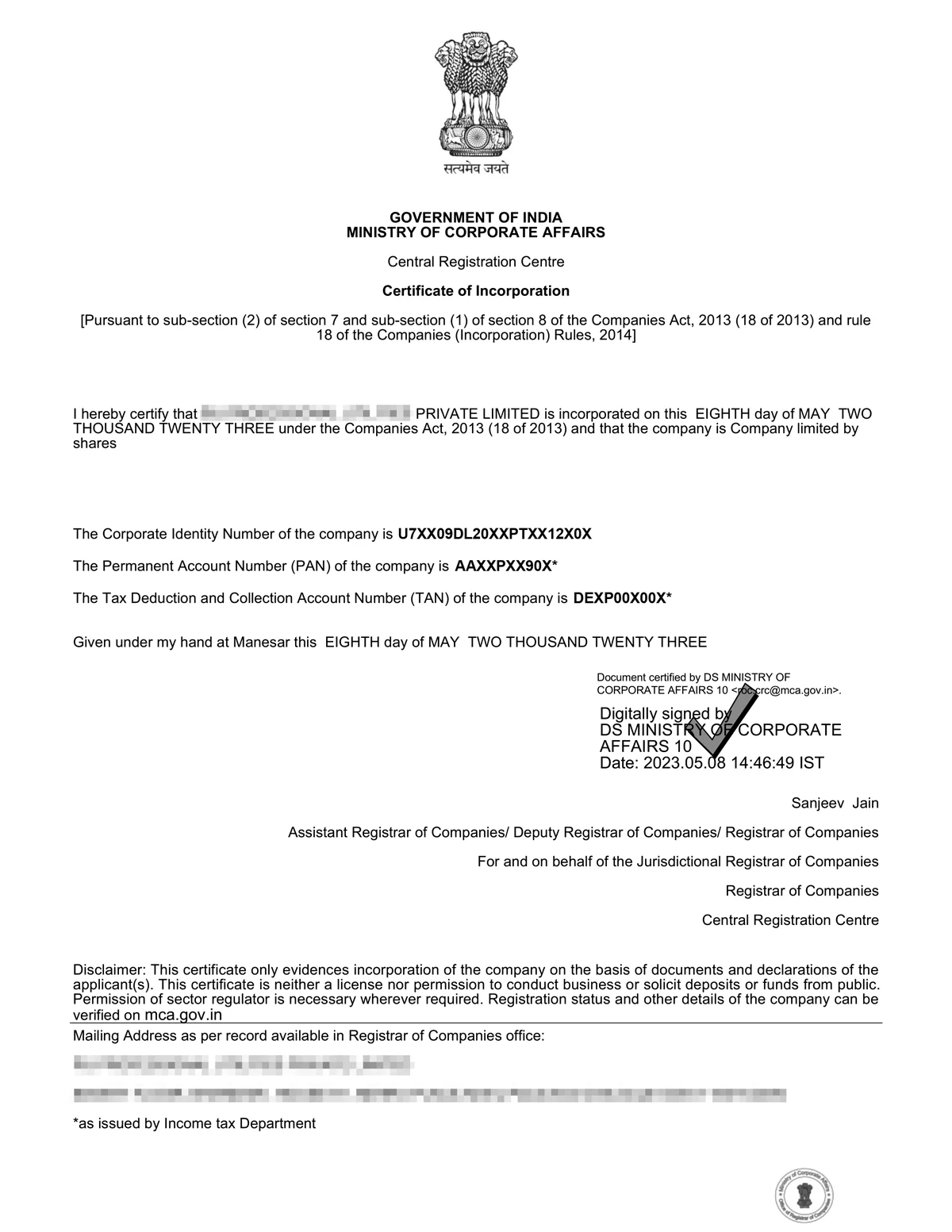

- Certificate of Incorporation (CIN)

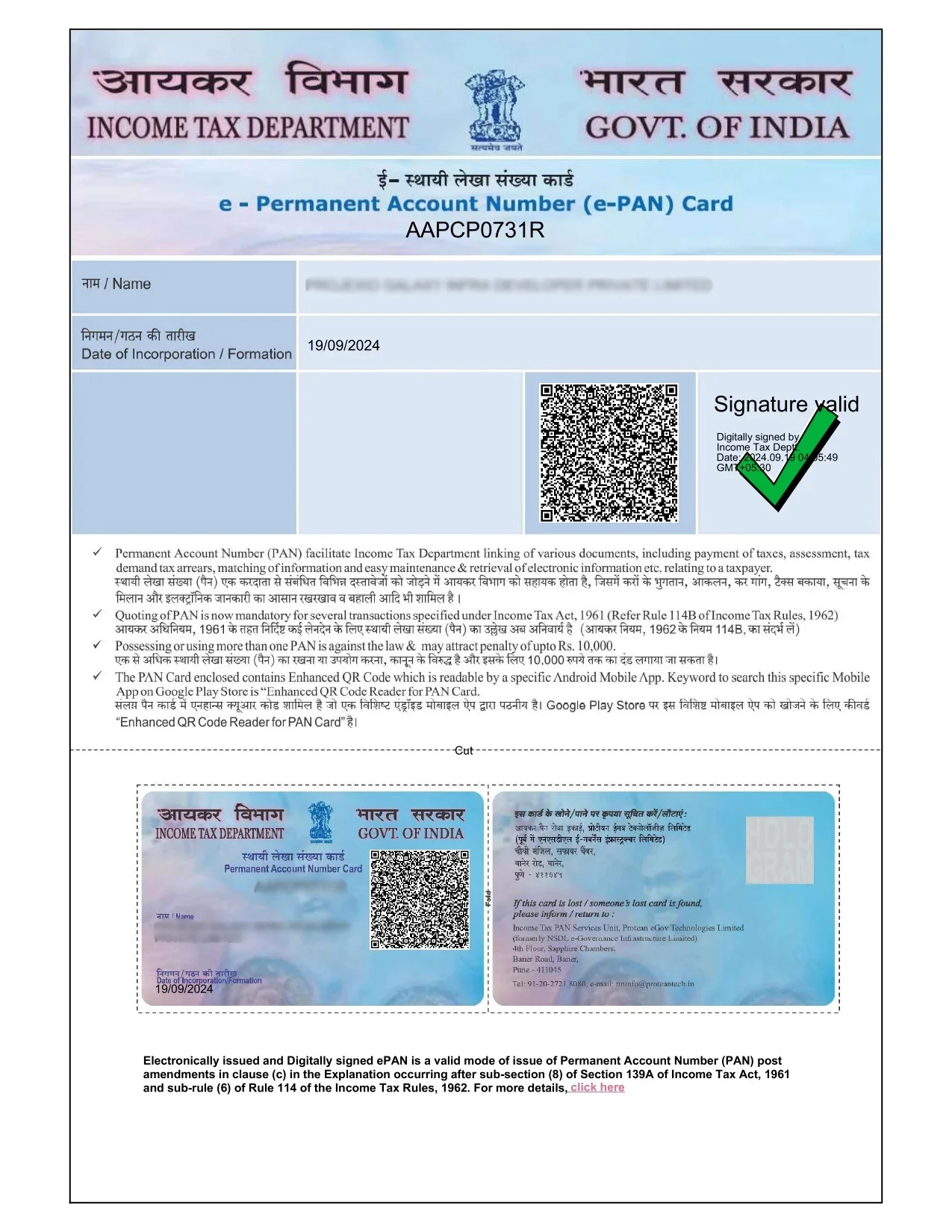

- PAN & TAN Allotment

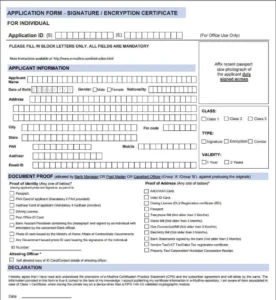

- 1 DSCs (Digital Signatures)

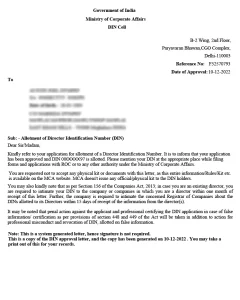

- DIN for Directors

- Bank Account Opening Assistance

Exclusive Free Benefits 🎁

Free Zoho Books (Accounting Software)

Free MSME Registration

Free GST Registration

Free Bank Account Opening

- Consultation with CA/CS/Advocate Free for Lifetime

10,000+ Companies & Individuals Put Their Trust In Us

✅ Clear Guidance: They explained every step in simple, easy-to-understand terms, so I always knew what was happening.

✅ Fast & Efficient: My filing was completed quickly without any unnecessary delays.

✅ Accuracy & Trust: I felt confident knowing my details were handled with care and precision.

✅ Great Support: Any small questions I had were answered patiently and thoroughly.

Are you experiencing hurdles for being a solo entrepreneur? Then, one person company registration is the right choice for you. By registering a one person company, you can reap several benefits, such as easy business formation, sole ownership and control, and fewer compliance requirements.

One person company registration in India was launched under the Companies Act 2013. This protects the sole ownership in India. This type of business incorporation also gives legal status to the companies registered as one person companies.

Section 2(62) of the Companies Act 2013 makes it possible for solo entrepreneurs to set up a one-person company with one member and one director. This formation gives individuals complete control of the organization while reaping full advantages of limited responsibilities. If you are wondering how to start a one person company in India, Click To Professionals is happy to help!

At Click To Professionals, we believe in maintaining an easy OPC registration procedure. Also, we make sure that independent business owners can navigate the tedious legal formalities seamlessly and cost-effectively. Our trained professionals are always available to assist you. From documentation to filing, we provide professional guidance to help you make detailed decisions about your OPC registration. Feel free to contact us and take the first step you bring your entrepreneurial dreams to life.

One Person Company Registration Benefits

Solo entrepreneurs can enjoy several perks of one person company registration online in India.

Take a look at the benefits of registering an OPC in India:

Less Compliance Needs

The Companies Act 2013 offers specific provisions to a one person agency connected with compliances, such as a one person firm does not require preparing the cash flow statement. Also, the company secretary doesn’t need to sign the annual returns and book of accounts. Only the director needs to sign them. The sole member can pass the minutes easily by entering them into the meeting book and signing it.

Limited Liabilities

Since a one person company is an individual legal body, it restricts the shareholder’s liabilities to their shareholding value. Also, one shareholder is not personally responsible for any loss the company encounters during its business operations.

Easier Fundraising

Since a one person company is a private agency, you can easily raise funds through angel investors, venture capitalists, incubators, etc. Financial institutions and banks like to lend to organizations instead of proprietorship agencies. Therefore, it becomes easier to raise funds.

Legal Entity Status

The member considers the one person company registration an individual legal standing. The sole individual who formed the OPC gets protection from its different legal entity status. The member is not responsible for the company's losses; their responsibility is restricted to the value of their shares. Hence, the creditors may not sue the OPC member or director.

Easy Company Management

A registered OPC can handle its operations and decide on effective company management without delay or conflict. Hence, the member can easily pass the unique or common resolutions by mentioning them in the minute book.

Continuous Repetition

An OPC features the function of constant repetition even with a sole member. That sole member should select a nominee during the One Person Company incorporation. That candidate will adopt all business operations if the sole member expires.

Less Compliance Needs

The Companies Act 2013 offers specific provisions to a one person agency connected with compliances, such as a one person firm does not require preparing the cash flow statement. Also, the company secretary doesn’t need to sign the annual returns and book of accounts. Only the director needs to sign them. The sole member can pass the minutes easily by entering them into the meeting book and signing it.

Limited Liabilities

Easier Fundraising

Less Compliance Needs

The Companies Act 2013 offers specific provisions to a one person agency connected with compliances, such as a one person firm does not require preparing the cash flow statement. Also, the company secretary doesn’t need to sign the annual returns and book of accounts. Only the director needs to sign them. The sole member can pass the minutes easily by entering them into the meeting book and signing it.

Limited Liabilities

Easier Fundraising

Legal Entity Status

The member considers the one person company registration an individual legal standing. The sole individual who formed the OPC gets protection from its different legal entity status. The member is not responsible for the company’s losses; their responsibility is restricted to the value of their shares. Hence, the creditors may not sue the OPC member or director.

Legal Entity Status

The member considers the one person company registration an individual legal standing. The sole individual who formed the OPC gets protection from its different legal entity status. The member is not responsible for the company’s losses; their responsibility is restricted to the value of their shares. Hence, the creditors may not sue the OPC member or director.

Easy Company Management

Continuous Repetition

An OPC features the function of constant repetition even with a sole member. That sole member should select a nominee during the One Person Company incorporation. That candidate will adopt all business operations if the sole member expires.

Tax Considerations for a One Person Company

OPCs have the same corporate tax status as PVT companies in India. Therefore, they depend on a flat 30% tax rate on their net profits, along with DDT (Dividend Distribution Tax) and MAT (Minimum Alternate Tax) as applicable.

However, there are some tax implications for these companies:

Perquisite taxation

No DDT (Dividend Distribution Tax)

GST (Goods and Services Tax)

FBT (Fringe Benefit Tax)

Tax audits

ITR (Income Tax Return)

Perquisite taxation

No DDT (Dividend Distribution Tax)

GST (Goods and Services Tax)

FBT (Fringe Benefit Tax)

Tax audits

ITR (Income Tax Return)

One Person Company Registration Requirements

You must submit the following one person company documents to the ROC (Registrar of Companies) to ensure a hassle-free one person company registration process:

- Address proof of the registered office, such as property deed, utility bill, etc.

- DIN or PAN Card of Directors

- The latest bank account statement of the Director

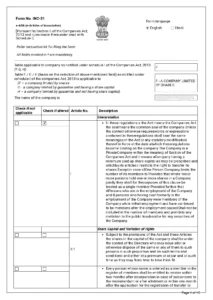

- MoA (Memorandum of Association)

- AoA (Articles of Association)

- NOC (No Objection Certificate) from the land owner

- Compliance Certificate

- Address and identity proof of shareholders

- Consent Form DIR-2

- Nominee appointment

- Visa Permit, Govt. IDs, or Passport of Foreign National

- Declaration Form INC-9

- Aadhar Card or Driving License of Directors

One Person Company Registration Steps

The step-by-step one person company registration process is given below:

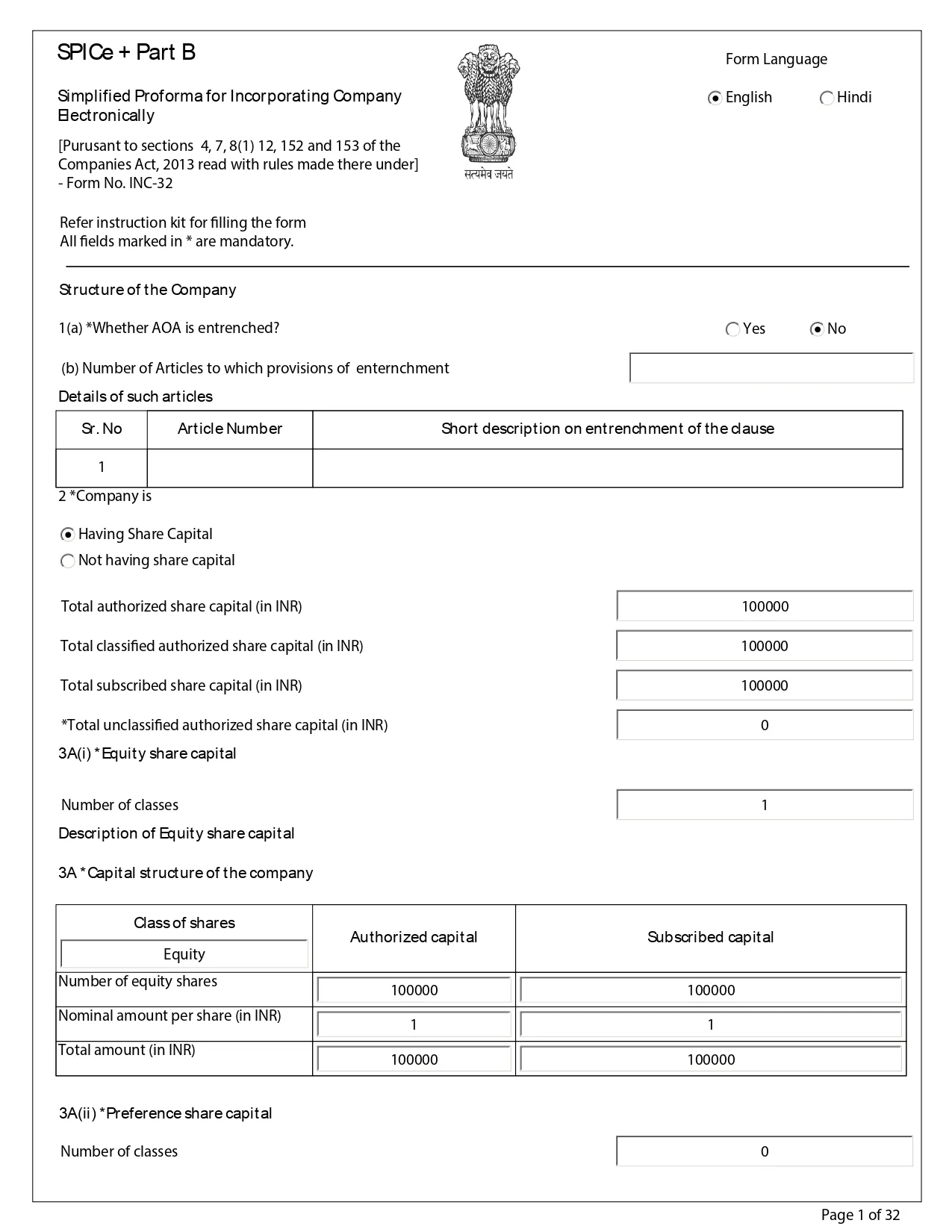

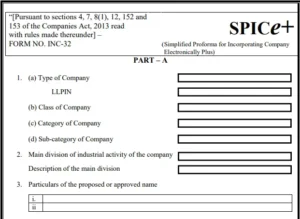

Once you get the DSC, you should apply for the DIN of the suggested director via the SPICe+ form alongside proof of address and the same person’s name. Form DIR-3 is an available choice for existing agencies only. Therefore, the applicants don’t have to file Form DIR-3 separately from January 2018. Currently, you can apply within the SPICe+ form for almost three directors.

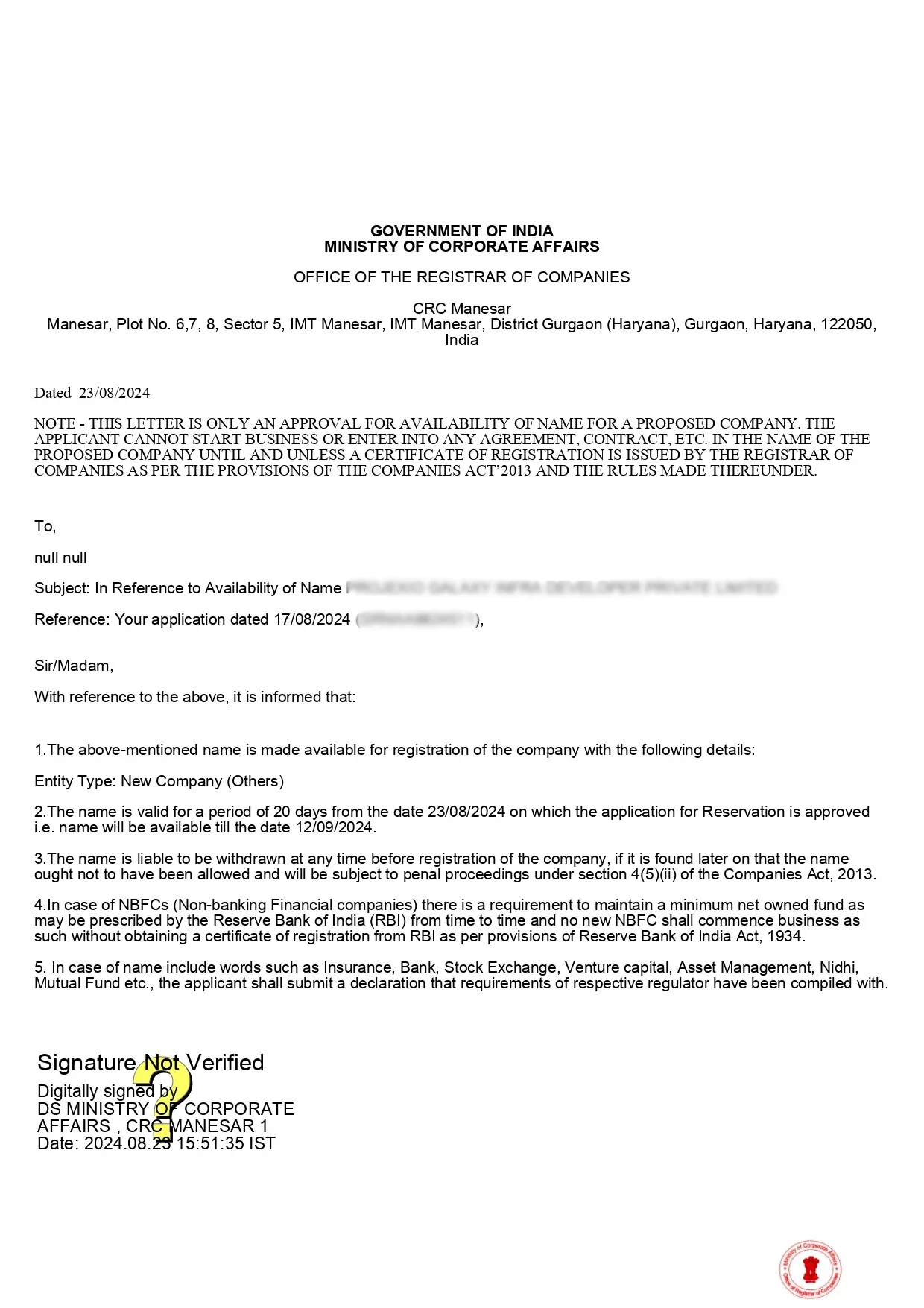

The third step for OPC incorporation is to apply for name reservation through the MCA portal via the SPICe+ form. Ensure you select a unique name for your organization, which must differ from any existing firm or trademark. You can submit only one name once. If the given name is refused, you can submit another name through another SPICe+ form application. You can find a unique name through our one person company name availability check tool.

Eligibility Criteria for One Person Company Incorporation

Before searching for one person company registration services online, be sure to check the eligibility criteria given below:

- At least one legal and natural member who is over 18 years old

- The promoter should be a citizen or resident of India

- Compulsory appointment of one nominee before registration

- The nominee should be a resident or a citizen of India

- Compulsory consent must be obtained from the nominee in Form INC-3

- A unique name of the company

- Digital Signature Certificate of the decided director

- The OPC should have at least INR 1 lakh in authorized capital

- The annual turnover limit of the company should not be over INR 2 Crores

- Restrictions of some businesses related to financial activities, such as banking, investments, or insurance

One Person Company Registration Timeline

The person who wants to be the director of the OPC can get the DSC and DIN in just one day. The director can get the COI (Certificate of Incorporation) in three to five days. The entire one person company registration process takes nearly ten days due to ROC approval and reverts from them.

Post-Registration Compliances for a One Person Company

Some compliances are mentioned in the Companies Act 2013 and they should be fulfilled by the decided deadlines. These rules give good governance, openness, and protect the interests of all parties, including shareholders, ROC, tax authorities, investors, and directors. Such compliances are divided into recurring compliances, annual compliances, and post-registration one-time compliances, and compliances based on events.

Here we have thoroughly outlined the post-incorporation compliances for a one person company:

One-time Compliances

An OPC should instantly comply with particular legal needs described by the Companies Act 2013. If needed, you can secure local incorporations according to the state laws of the area where the company is running business.

Here is the complete list of compliances alongside the due dates:

- Hiring the first auditor (within one month of registration)

- Issuing Share Certificate (within two months of registration)

- Stamp duty payment on the Share Certificate (within one month of Certificate Issue)

- Filing of INC-20A (within six months of registration, but before business commencement)

- Total subscribed capital obtained

- Opening current bank account

- Registered office details filing

- Maintaining registered address

For detailed discussions, feel free to get in touch with our consultants.

One Person Company Registration Packages

Perfect for starting company incorporation

- Professional assistance

- Reservation of your company name in only 2-4 days

- DIN for directors

- SPICe+ form filing in only two weeks

- DSC in only 4-7 days

- Company PAN and TAN

- Certificate of Incorporation in 2-3 weeks

Fast company registration in 1-2 weeks

- Professional assistance

- DSC in only 3-4 days

- Certificate of Incorporation in 1-2 weeks

- DIN for directors

- ADT 1 and INC 20A form filing

- Reservation of company name in only 1-2 days

- SPICe+ form filing in just 5-7 days

- PAN and TAN of the company

- A digital welcome kit that contains a checklist for all post-registration compliances

Top-notch priority service and annual compliance to keep a business on track

- Professional assistance

- Reservation of company name in only 1-2 days

- DSC in only 3-4 days

- SPICe+ form filing in just 5-7 days

- Certificate of Incorporation in 1-2 weeks

- DIN for directors

- PAN and TAN of the company

- ADT 1, AOC 4, MGT 7, and INC 20A form filing

- Hiring an auditor

- DIR 3 KYC (for two directors)

- Preparing financial statement

- Issuing Share Certificate

- Accounting software (one year license)

- Conducting AGM (Annual General Meeting)

- 30-minute call with an expert CS or CA for your business strategies

- Statutory regulations Provident Fund, ESI

- Accounting and Bookkeeping (up to 100 transactions)

- 1 year income tax filing (up to turnover of INR 20 lakh)

- Yearly filing (up to turnover of INR 20 lakh)

Why Choose Click To Professionals?

Professional Consultation

We have a team of professional consultants who offer one person company registration services in India.

100% Success Rate

Our expert team has maintained a 100% success rate in online OPC registration.

One Person Company Name Availability Check

You can use our one person company name availability check tool to search for a unique name for your business.

Conversion Service

Our team also offers the service of converting an OPC to a PVT Company if the eligibility criteria are met under the Companies Act 2013.

One Stop Business Solution

Click To Professionals is well-known for offering a one-stop business solution related to the one person company registration under the Companies Act 2013.

Find a local agent for your legal & registration service

+91 8448094507

Phone No.

info@clicktoprofessionals.com

Get Support

Frequently Asked Questions (FAQs)

An OPC does not get a tax benefit over other business formations. Tax provisions like Dividend Distribution Tax and MAT apply to this formation. The tax rate is 30%.

A one person company has only one shareholder, does not need to appoint more than one director, and has limited liability. On the other hand, a private limited company needs at least two directors and two shareholders, providing the capacity to raise funds through share issuance and limited liability.

Generally, it takes seven to ten working days to register a one person company in India, based on document authentication and approval.

GST registration is compulsory for OPCs supplying products and services outside the state.

Yes, you can register an OPC online through the one person company registration government website.

One Person Company Registration

It might be hard to start your own business, especially if you’re doing it alone. But what if you could start your dream business without a partner or a big team? That’s where the One Person Company Registration (OPC) comes in. It’s a sensible, easy, and organised approach to start. And the best part? It’s easy to accomplish anything online, from registering a company with the OPC to filing a ROC income tax return.

In this article, we’ll talk about why OPC is a wonderful choice for new business owners, what the One Person Company Registration Fees are, and how you may Register One Person Company and keep up with your taxes by filing your ROC Income Tax Return.

What is OPC, and why is it so important?

The Companies Act, 2013 lets a single person register a corporation as an OPC, or One Person corporation. Unlike a sole proprietorship, an OPC gives you limited liability, superior reputation, and a professional business structure. OPC Company Registration Online is the best approach to give your idea a legal name if you’re a freelancer, a small business owner, or just starting out as an entrepreneur.

You don’t need a co-founder or more than one director when you register your OPC online. There can only be one director and one shareholder. It’s easy to use, cheap, and perfect for solitary entrepreneurs.

One Person Company Registration Has Many Benefits

Such as Legal Identity and Filing ROC Income Tax Returns

Your business will have a legal identity once you finish registering your One Person Company Online. This assists in creating confidence with clients, obtaining for loans, and complying with ROC Income Tax Return Filing. When you file returns with ROC, the Ministry of Corporate Affairs (MCA) will recognise and regulate your business.

Limited Liability with OPC Registration: A Cost Advantage

The fundamental difference between registering a sole proprietorship and an OPC company is that the latter has restricted responsibility. If your firm loses money, you won’t forfeit your personal property. Also, the OPC registration fee is lower than those of other types of businesses.

How to Register a One Person Company in India in Steps

Step 1: Get a Digital Signature Certificate (DSC)

Getting a DSC for the intended director is the first step in registering a One Person Company. This is required to submit forms on the MCA portal.

Step 2: Get a Director Identification Number (DIN)

After you obtain your DSC, the next step is to apply for a DIN. This is required for the only director of your Single Person Company Registration.

Step 3: Reserve a Name

The MCA portal has a form called RUN (Reserve Unique Name) that you can use to apply for name reservation. This is a very important part of OPC Registration Online.

Step 4: Filling out the forms for incorporation

After you reserve the name, send in Form SPICe+ and all the other papers. This includes registering for a PAN, TAN, and GST, which makes it easy to Register OPC Online all at one.

Step 5: Following the rules for ROC income tax return filing

After your One Person Corporation Registration is granted, you have to file ROC forms such AOC-4 and MGT-7 every year, as well as ROC Income Tax Return Filing.

Documents Needed to Register an OPC Online: The Owner’s PAN Card

Aadhar card

Statement from the bank

Electricity bill (office evidence)

Picture the size of a passport

Certificate of Digital Signature

Nominee’s consent (because OPC needs a nominee)

These are the basic things you need to do to finish OPC Company Registration Online quickly.

Cost Breakdown: Fees for registering a one-person company

Let’s learn about how much it costs to register a One Person Company.

Details Cost (About)

₹1,500 for DSC and DIN

₹1,000 for Name Approval

Government Fees and Stamp Duty: ₹1,500 to ₹2,500. Professional Fees: ₹3,000 to ₹6,000.

The total cost of registering for an OPC is between ₹7,000 and ₹12,000.

So, the OPC Registration Fees are reasonable, especially when you think about the legal protection and company reputation you get.

Filing ROC income tax returns for OPCs is a must!

After you register your OPC company, you need to file your yearly returns and financial statements with the ROC. Even if there are no sales, you still have to file your ROC income tax return.

Here’s what you need to do annually:

Form AOC-4: Sending in financial statements

Form MGT-7: Sending in an annual return

Use ITR-6 to file your income tax return.

Audit: If turnover surpasses ₹1 crore (₹50 lakhs for professionals)

All of these filings are part of ROC Income Tax Return Filing, which makes sure that everything is clear and follows MCA rules.

Things to Avoid When Registering an OPC Company

Ignoring Nominee Requirement

When you register your One Person Company, you have to choose a nominee. If the only director can’t go on, this person will take over.

Not filing ROC on time

A lot of people neglect to file their ROC income tax return. Delays might result in big fines and potentially the director’s disqualification.

Not Knowing How Much It Costs

Know what makes up the One Person Company Registration Cost. Don’t just look at the professional price; think about other costs like stamp duty and government fees as well.

Who Should Opt for OPC Registration Online?

If you are a freelancer or consultant

Starting a tiny business

Wanting to limit risk

Testing a business idea before growing

Single Person Company Registration is the best option for you. The OPC Registration Online process is straightforward and takes approximately 7-10 days if done properly.

Benefits of OPC Over Sole Proprietorship Feature OPC Sole Proprietorship Legal Status Separate legal entity

Not a separate thing

Limited Liability

Unlimited ROC Filing and Compliance, as well as Mandatory ROC Income Tax Return Filing

Not applicable. Funding Opportunities

More Limited Business Credibility

High Low

It’s clear that registering as a one-person corporation gives you more security and chances than being a single proprietor.

Can OPC Be Changed Later?

Yes, you have to change your OPC into a private limited company if your turnover is more than ₹2 crores or your paid-up capital is more than ₹50 lakhs. You can easily do this using the MCA site while keeping the business going.

This indicates that starting with One Person Company Registration allows you the freedom to become big when the time is appropriate.

Why Should You Register Your OPC Online?

No more standing in huge lines or filling out paperwork. Everything from DSC to final incorporation is done online using Online OPC Registration. It’s quicker, safer, and less expensive. Most systems have bundles that include:

Sign up for OPC Company

GST and PAN

Reminders for ROC compliance

Help with filing your ROC income tax return

So you may focus on your business while specialists handle the legal job.

Conclusion

OPC Company Registration Online is the best option to start a business legally and sensibly if you have an idea for one. It’s cheap, easy, and great for people.

The whole process is now easier and more accessible, from registering a one-person company to filing an annual ROC income tax return.

You may build a reputable brand with One Person Company Registration Online.

Cut down on your debts

Get tax breaks

Get financing from banks and investors

Make sure you follow professional rules

What are you waiting for? Sign up for One Person Company today and take the first step towards your dream of being an entrepreneur!

Contact Us:

Call us at +91 84480 94507 or email us at info@clicktoprofessionals.com for any queries.

Choose Click To Professional – Your Partner in Business Success.