Income Tax Return (ITR) Filing

Expert Tax Filing Just a Click Away—Get Started Now!

Stay Compliant and Maximize Savings!

Get Your Tax Return Filed Today—It’s Quick and Easy!

- Get Instant Quote

What’s Included ✅

- Consultation on Correct ITR Form (ITR-1 to ITR-7)

- Preparation & Filing of ITR Online

- Assistance in Claiming Tax Deductions & Exemptions

- Computation of Tax Liability / Refunds

- Filing Acknowledgment (ITR-V) & E-Verification Support

- Expert Assistance for Salary, Business, Capital Gains, and Other Income

Exclusive Free Benefits 🎁

- Free Check Which ITR You Should File – No form confusion.

- Free Guide on Saving More Tax – Simple tips & deductions.

- Free Refund Tracking Assistance – We’ll keep an eye for you.

- Free Checklist for Documents Needed (PDF) – So you’re always ready.

- Free Consultation Call on Future Tax Planning – Pay less tax legally.

- Consultation with CA/CS/Advocate Free for Lifetime

10,000+ Companies & Individuals Put Their Trust In Us

✅ Clear Guidance: They explained every step in simple, easy-to-understand terms, so I always knew what was happening.

✅ Fast & Efficient: My filing was completed quickly without any unnecessary delays.

✅ Accuracy & Trust: I felt confident knowing my details were handled with care and precision.

✅ Great Support: Any small questions I had were answered patiently and thoroughly.

Income Tax Return (ITR) Filing

In India, every taxpayer should file an income tax return online, following the country’s tax regulations. It includes the details of income sources, tax liabilities, and deductions of the taxpayer. ITR filing on time helps avoid late fees and penalties, ensuring a seamless submission procedure. Businesses, individuals, and others must file their income tax returns annually.

At Click To Professionals, we help businesses and individuals avoid interest in overdue taxes and the risk of penalties. Moreover, we allow taxpayers to remain updated with the latest tax regulations. July 31, 2024, is the last date for filing your ITR for the Financial Year 2023-24 (Assessment Year 2024-25) without giving a late fee.

Overview of Income Tax Return

The tax levied on a person’s income is income tax. The Central Government charges and collects this tax. Income tax is payable in the same Financial Year that it was earned in the form of advance tax. However, the income assessment, intimation, and tax liability are given in the Assessment Year. Such an intimation form is known as an Income Tax Return. The time limit and form for Income Tax Return Filing differ for various taxpayers depending on the criteria.

You can find seven different income tax return e-filing forms: ITR 1 through ITR 7. An appropriate form for a taxpayer depends on factors such as their income sources, total earnings, and the kind of taxpayer they are (such as organizations, individuals, etc.). Every taxpayer should properly finish and submit their income tax return forms by a particular deadline for complying with tax regulations.

Income tax return forms have recently been changed to ease the user experience. However, through these changes, taxpayers may be liable to prove a claim of exemptions, costs, and deductions. Therefore, filing income tax returns online needs experts’ help to ensure an appropriate filing of returns.

Overview of Business Tax Return

A business tax return refers to an ITR for businesses. It’s a detailed report that mentions a business’s pertinent tax information, costs, and income, everything outlined appropriately. It involves the ITR submission for businesses, with an extra need for reporting TDS (Tax Deducted at Source). This is an annual procedure.

The business tax return works as a financial statement outlining earnings. It’s a documentation of extra financial elements, such as loans received, fixed assets, debtors, loans maximized, and creditors inside a business. It is essential to fulfill the ITR filing due date for businesses.

Different Types of Income Tax Return Forms in India

The Government has made different income tax return forms through the Central Board of Direct Taxes for various taxpayers. These forms vary depending on the income sources and the taxpayer’s category.

Here is a quick breakdown:

- ITR-1

- ITR-2

- ITR-3

- ITR-4

- ITR-5

- ITR-6

- ITR-7

Who Should File an Income Tax Return?

Filing income tax returns is a different group's legal and financial duty under various circumstances. Here’s who needs to file it:

All corporate bodies, such as LLPs, private limited companies, and conventional partnerships, should file their ITRs online yearly, irrespective of profit or loss.

If your total earnings before deductions surpass the exemption limit (under Sections 80C-80U), you should file an ITR.

You should file your income tax return if you get dividends from bonds, mutual funds, fixed deposits, equities, and interest. This ITR e-filing ensures that all income sources are reported and taxed appropriately.

Individuals working as directors in PVTs or serving as partners in LLPs should file income tax returns based on their financial activities and income within the organization.

Tech professionals and NRIs should file their ITR if their income sourced in India exceeds the critical exemption limit or includes a particular financial transaction.

Income from handling voluntary contributions, religious trusts, or charitable funds also needs the ITR e-filing to follow and maintain transparent tax regulations.

Self-employed workers, such as agents, consultants, and freelancers, can claim expenses directly associated with a business as a tax-deductible cost.

Income Tax Return Due Date for Individuals

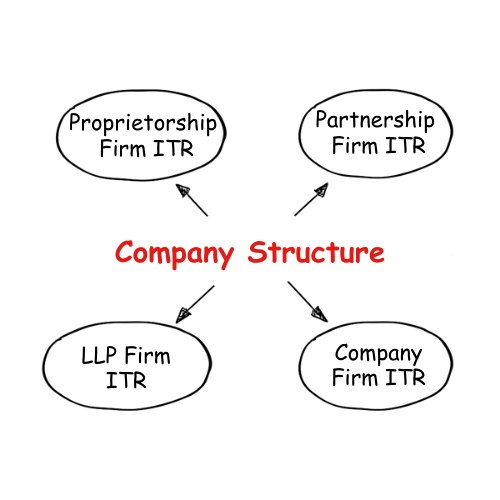

Company Structures in India

Proprietorship Firm ITR Filing

Requirement for ITR filing

- Proprietors below 60 years must file ITR if total income surpasses INR 2.5 lakhs

- Proprietors above 60 but below 80 should file ITR if total income surpasses INR 3 lakhs

- Proprietors above 80 and more should file ITR if total income surpasses INR 5 lakhs

Income Tax Rate

Tax Audit

Proprietorship firms need an audit if the total sales turnover exceeds INR 1 crore during the financial year. In case of an expert, an audit would be important if total gross receipts exceed INR 50 lakhs during the financial year under analysis.

Last date for ITR filing

The last date of the ITR of a proprietorship firm that doesn’t need audit is 31st July. If the return should be audited according to the Income Tax Act, its last date will be 30th September.

ITR form for filing

Proprietorship firms would need to file Form ITR-3 or ITR-4. A proprietor or a HUF running a proprietary business can file the Form ITR-3. A proprietor who wants to pay income tax under the PTS (presumptive taxation scheme) can file the Form ITR-4.

Partnership Firm ITR Filing

Requirement for ITR filing

- A partnership firm should file ITR every year, regardless of profit or loss. If there is no activity, the firm should file a NIL ITR before the last date

Income Tax Rate

MAT (Minimum Alternate Tax)

- A MAT of 18.5% of modified total income is applicable.

Tax Audit

Partnership firms running businesses with total sales of more than INR 1 crore should get tax audits. Likewise, partnership firms carrying on a profession with total income of more than INR 50 lakhs should get tax audits.

Last date for ITR filing

The last date for ITR filing for most partnership firms is 31st July of the assessment year. However, these firms needed to get their accounts audited under the Income Tax Act should file the ITR before 30th September business ITR filing due date.

ITR form for filing

Partnership firms should file ITR in Form ITR-5. This is an attachment-less form and there is no need to submit any statement or document along with the ITR.

LLP ITR Filing

Requirement for ITR filing

- LLPs must file ITR every year, regardless of income or loss. In the case of no activity, the LLP should file a NIL ITR before the last date

Income Tax Rate

MAT (Minimum Alternate Tax)

- Like partnership firms, a MAT of 18.5% of modified total income is applicable for LLPs.

Tax Audit

A practicing CA should audit the accounts of LLPs whose contribution surpassed INR 25 lakhs or whose turnover surpassed INR 40 lakhs. Also, LLPs that carry a foreign transaction with related entities or undertook some specified domestic transactions should file Form 3CEB that should be certified by a CA. the last date for filing the Form 3CEB is 30th November.

Last date for ITR filing

The last date for ITR filing for LLPs is 31st July. However, LLPs needed to get a tax audit should file the ITR before 30th September business ITR filing due date.

ITR form for filing

LLPs should file ITR in Form ITR-5. This form should be filed digitally using one of the designated partners’ online signature.

Company ITR Filing

Requirement for ITR filing

- All registered companies should do business ITR filing annually, regardless of profit, income, or loss. In fact, dormant companies with zero transactions should also file ITR yearly

Income Tax Rate

MAT (Minimum Alternate Tax)

- A MAT of 15% of book profit plus education cess and surcharge is applicable for companies if the company’s liability does not exceed 15% of book profit

Tax Audit

Regardless of profit/loss or turnover, a CA must audit the accounts of a company every year.

Last date for ITR filing

All registered companies in India should file ITR on or before 30th September.

ITR form for filing

Companies registered and operating a business in India for profit should file Form ITR-6. Therefore, limited companies, private limited companies, and one-person companies should file Form ITR-6.

Benefits of Income Tax Return Filing Online

Income tax return e-filing offers an array of legal and financial advantages. Please find a few of them below:

ITR filing enables you to claim deductions, eliminating the tax burden. You can avail of these deductions through investments. These deductions can include rebates and TDS.

Showcasing a continuous tax record through online tax filing can accelerate the approval procedure for credit cards and loans. This demonstrates stable income and financial dependability.

Many businesses experience losses in their initial years. The capital or business losses can be carried forward up to eight years in the case of an ITR filing. You can adjust this loss against your future income, which reduces taxable income. You won’t get this benefit if your ITR is not filed.

Freelancers or other self-employed individuals who don’t have an official income statement can use their ITR returns to verify their income.

ITR acts as legal proof in these two ways:

- Income proof: The income tax return form comprises comprehensive details on expenses and incomes, acting as income proof for transactions like buying properties.

- Identity proof: You can use your ITR filing as an identity proof. The Government acknowledges it for different matters, including getting an Adhar card.

Despite being an eligible taxpayer, if you fail to file your ITR, you can face punishments and penalties. According to the Income Tax Act 1961, you may need to give penalties of up to INR 5000 for non-compliance. Therefore, ensure that you file promptly to avoid these unnecessary expenses.

ITR filing is essential if you plan to go abroad. Several nations need income tax returns as a document for visa approval. After all, it gives details of financial history to the embassy.

If you have paid more tax than you are liable to (through TDS, etc.), ITR online filing is essential for claiming a refund. This income tax return filing refund procedure is easy and quick in e-filing.

Essential Documents for Income Tax Return Filing

While filing your ITR online, you should have all essential documents ready to experience a seamless and appropriate filing.

Here is a list of documents you may need for the filing process:

- PAN Card of the taxpayer

- PAN card of all partners or directors (in the case of a company)

- Aadhar card of all directors or partners (in the case of a company)

- Cancelled cheque from the taxpayer’s bank account

- Financial statements for business entities (except proprietorship)

- The bank account statement of the taxpayer for the concerned financial year

- The TDS certificate (also known as Form 16) of salaried individuals

- Expenditure u/s 80 or the investments made

Online Income Tax Return Filing Tips

Both online and offline methods are available to achieve income tax return e-filing. Online ITR filing is more accessible, and let’s have a look at some steps to follow for ITR filing online:

Get in touch with our experts

Consult our tax professionals to fix your queries. We have our in-house CA to give you customized advice for saving on taxes.

Submit all necessary documents

According to the need, ensure to submit all investment documents and income statements to our team.

Get your ITR Filed

Depending on the condition, our experts will choose appropriate ITR forms and file them timely on your behalf.

Click To Professionals is always ready to help you effortlessly file your income tax return with complete guidance and assistance.

Income Tax Return Filing Penalties

While filing your ITR, you should meet the income tax return filing due date to increase benefits and avoid penalties.

Loss adjustment

Online filing of income tax returns on time enables you to carry forward losses from business operations or investments. This can balance your future income tax liabilities. Failure to file ITR on time cannot offer you this benefit.

Late filing fee

As stated by Section 234F, you must pay a late fee if you miss the deadline for ITR filing. The late fee is INR 5000 but is lowered to INR 1000 if your total income is not more than INR 5 lakh.

Interest

If you miss the income tax return filing deadline, you must pay an interest fee of 1% per month on your unpaid tax amount under Section 234A.

Find a local agent for your legal & registration service

+91 8448094507

Phone No.

info@clicktoprofessionals.com

Get Support

Critical Income Tax Return Filing Mistakes

While filing your income tax return online, you may experience several mistakes that complicate the process or even cause penalties. You should beware of these mistakes to experience a seamless e-filing of ITR:

Wrong PAN or personal data

Mistakes in providing your PAN, date of birth, name, or address can cause the delayed processing or refusal of your tax return.

Selecting the wrong tax form

Various income tax return forms serve different taxpayer statuses and income sources. You should choose the correct ITR form depending on your income type, as stated on the Income Tax Department’s website.

Missing out on claiming eligible deductions

Some taxpayers forget to eliminate their tax liabilities by not claiming eligible deductions for investments, savings, and some costs permitted under the Income Tax Act 1961.

Wrong bank details

Giving incorrect bank account details can slow your ITR refund. Enter the correct bank account number, IFSC, and other essential data.

Not verifying the return online

After e-filing the income tax return, you should verify it online within the decided timeframe. An unverified return is considered an unfiled one.

Not reporting all income sources

You must disclose all income sources during the year. If you cannot report them, it will be considered tax evasion and can cause you penalties.

Not disclosing capital gains from mutual funds

You should pay tax for short-term and long-term capital gains from mutual funds. Ensure to report these gains properly to avoid penalties.

Filing after the last date

Late ITR form submissions can cause fines and penalties. You should file your ITR before the last date to avoid the extra expenses.

Ensure that these mistakes are avoided to make your return process compliant with tax regulations. Our professionals can guide you through this e-filing process at Click To Professionals.

Why Choose Click To Professionals for ITR Filing?

At Click To Professionals, we provide India’s best ITR filing services. We understand that ITR filing is a time-consuming and complicated process. Therefore, we offer an effortless filing service. Our experts are well-versed with the latest tax regulations and can guide you through filing.

As one of India’s leading ITR filing service providers, we provide our services at budget-friendly rates, and there are no hidden charges. Our ITR filing service is effective, fast, and secure enough to give you the utmost peace of mind.

Frequently Asked Questions (FAQs)

If you fail to file the ITR within the deadline, you must pay a late fee for filing your return up to a specific date with lowered benefits.

Online Income tax Return Filing

It might be a pain to file your taxes, particularly if it’s your first time. But in today’s digital age, Income Tax Return Filing is quicker, easier, and more accurate. Don’t worry if you’ve ever wondered, “Why is filing taxes so hard?” This guide is meant to make things easy, stress-free, and only a click away.

This article will teach you how to submit your income tax return online like a pro, whether you work for someone else, are self-employed, own a business, or are in charge of making sure a corporation follows the law.

What does it mean to file a income tax return?

ROC Income Tax Return Filing is the process of sending in your income tax returns and following the rules set by the Registrar of Companies (ROC) if you operate a business. It makes sure that both your personal and business tax returns are submitted correctly.

You may now quickly submit your ITR and any ROC-related papers online with very little labour. Thanks to online tax return services, your life is simpler.

Why Should You File Your ITR Online?

Not only is it required by law to file your income tax return, but it may also help you in many ways. Here are some reasons why you should submit your taxes online:

Get Your Money Back Quickly: You may get a refund after e-filing if TDS has been taken out.

Proof of income is needed for government contracts, loans, and visa applications.

Avoid Penalties: If you don’t file your taxes online on time, you’ll have to pay late penalties and interest.

Compliance Peace of Mind: It’s very important for business owners to follow ROC rules.

Fast and easy: You may now do your taxes from home.

ROC Income Tax Return Filing makes sure that you are both legally and financially organised, whether you are a person or a business.

How to File Your Income Tax Return Online in India: A Step-by-Step Guide

This is how you may begin your road towards filing your taxes smartly:

1. Get all the papers you need. You will need:

PAN card

Aadhaar card

Form 16 (for those who work)

TDS papers

Proofs of investment

Statements from the bank

If you’re a business, you need to send in your financial statements and audit reports when you file your ROC Income Tax Return.

2. Sign up for the Income Tax Portal

Make an account on the official website for submitting your income taxes online.

3. Pick the Right ITR Form

Depending on the sort of income you have, there are many ITR forms, including ITR-1, ITR-2, ITR-3, and so on.

4. Add the Information

Make sure all of your information is correct, whether you file your taxes online or use a professional.

5. Check and Send

You may e-verify your return once you send it in using Aadhaar OTP or nett banking.

Why You Should Use ROC Income Tax Return Filing Services

Here’s why sensible people and companies increasingly choose to hire professionals to file their taxes:

No more mistakes in calculations.

Faster Processing: E-filing makes sure that your tax return gets to the department right away.

Put all of your tax and business filings in one place for ROC compliance.

Professional assist: Professionals assist you get the most deductions.

No more worrying about deadlines or fines.

A List of Mistakes People Make When They File Taxes Online

Even if it’s simpler to submit your income tax online today, a lot of individuals still commit errors that they might have avoided:

Putting in the wrong PAN or bank information

Choosing the incorrect ITR form

Not reporting excess income, such interest

Not meeting the deadline

Not checking the return

To successfully e-file your income tax and keep in line with ROC rules, you need to avoid these blunders.

When do you need to file your taxes?

In India, the typical deadline for individuals to submit their income tax returns online is July 31, and for businesses, it is October 31. Companies must complete Form AOC-4 and Form MGT-7 every year for ROC filings.

Don’t put it off until the last minute. Filing your ROC income tax return early lets you avoid late fines and allows you plenty of time to fix any mistakes.

Can You Do Your Own Taxes Online?

Of course. You may submit your ITR online yourself by going to the income tax e-filing site. It is best to hire expert services if you are not sure or if you own a company or startup.

A tax filing specialist knows the most up-to-date laws, helps you claim all the deductions you’re entitled to, and makes sure your income tax and ROC Return Filing are filed correctly.

What Makes ROC Filing Different from Filing Taxes

Both entail reporting on finances, but there are several important differences:

Type: Filing an Income Tax Return Individuals and corporations must file ROC. Companies that are registered with the MCA are overseen by the Ministry of Corporate Affairs (MCA) and the Income Tax Department.

Important Forms ITR-1 to ITR-7, AOC-4, MGT-7, ADT-1, and so on.

Purpose: To figure out taxes and send them in Reporting on the company’s finances and compliance

Punishments Fees for being late, interest on taxes Big fines for not submitting or filing late

Using both ROC Income Tax Return Filing services saves time and makes things less confusing.

One Click to File ITR Online

You may now submit your income tax online in just a few steps on several sites. You upload the papers, and specialists take care of the rest, from doing the math to submitting them. This is quite useful for company owners and busy professionals who want to keep compliant without spending a lot of time.

You can do the following with one dashboard:

Keep an eye on the progress of your file

Get your refunds by downloading them

Get reminders about due dates

Handle ROC submissions and e-file income tax returns

Things to Look for in a Good Online Tax Return Service

Choose a provider that provides the following if you want to submit your taxes online:

Dashboard that is easy to utilise

Help from experts

Alerts and reminders

Keeping data safe

Prices that are reasonable

Solutions for filing a ROC income tax return together

Platforms like ClickToProfessionals make it easy, fast, and cheap to file your taxes online.

Conclusion

Now is the time to submit your return if you haven’t already. Delays might cost you money and advantages. ROC Income Tax Return Filing is the way to go if you want to file your taxes without any problems, whether you work for yourself, for a salary, or as a business director.

Filing your income tax return online is not a hassle; it’s a sensible way to be open about your finances, stay legal, and save money in the long run.

Frequently Asked Questions

Q1: Is submitting a ROC and an income tax return the same thing?

No. Filing a ROC income tax return comprises both filing an income tax return and filing for ROC compliance. One is for taxes, and the other is for following the law for businesses.

Q2: Is it possible to submit my income tax return online for free?

Yes, you may file your income taxes online for free using the government webpage. But it’s best to use a professional provider for extra help and precision.

Q3: What do I do if I miss the ITR deadline?

You will have to pay late fees and interest, and you may not be allowed to roll over losses. Always submit your ITR online before the due date.

Do your taxes online now to get started!

Don’t wait until the last minute to panic. The ideal approach to pay taxes, whether you’re a person or a company owner, is to do it online utilising a platform that is safe and endorsed by experts.

Contact Us:

Call us at +91 84480 94507 or email us at info@clicktoprofessionals.com for any queries.

Choose Click To Professional – Your Partner in Business Success.